Possible Scenarios for the Future: Stoneleigh

Stoneleigh (aka Nicole Foss) is – in my opinion — right on target with her understanding of the big picture, and the show isn’t over yet.

Stoneleigh explains that much of what might look like solid substance in our economy is really inflated valuations, exotic derivative financial vehicles, and credit. Like a bubble blown in chewing gum, these devices haven’t made the gum-wad grow; rather they’ve created the illusion of tremendous “growth.”

In Stoneleigh’s June 2010 UK Transition Conference talk, she brings out the issue of the credit markets. In my talks I call those the dandelion fluff. Let me explain that:

An economy should be built upon fairly solid transactions: I build a chair, and you buy it. You bake a loaf of bread, I buy it. These are solid economic transactions. But it gets really weird and warped when one bank is buying another bank’s mortgage paper at a discount, or you’re buying a stock which is valued not by underlying assets but merely by its popularity in the market, or you’re drawing cash out of a refinance on the real-estate-bubble-inflated value of your house.

That’s fluff.

At present, fluff transactions amount to 369% of the solid transactions! Our economy is very much out of touch with the real stuff of the planet.

(As an aside, even those supposedly solid transactions in the GDP figures are far from it; many of them are fluff as well. Read about what they put into the GDP figures.)

Stoneleigh asks us to think of a pie. Rather than us each owning our share of the pie, she describes this credit bubble as creating multiple competing exclusive claims on the same piece of pie. In other words, for each single slice of pie – each real, solid item within the economy – we have the equivalent of 3 to 4 competing creditors and financiers each claiming the exclusive and conflicting “right” to trade the value of that single slice of pie.

Referring to the emotions-of-a-market diagram again, you’ll see what I mean that the show isn’t over yet. Stoneleigh’s broader market projections match those of Robert Prechter about the depths to which the markets will eventually decline. Stoneleigh expects real estate values to return to the levels of the 1970s. Both say the financial markets are headed for a drop so steep, and for so long, that we will not trust the stock market system again in our lifetimes.

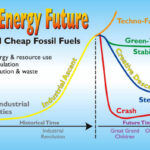

We are moving towards an energy-poor future. With less energy we will not be able to have the same kind of economy or society.

Expect:

• High interest rates on remaining debt, and high taxes

• Bank runs, bank holidays and lost savings

• Asset price collapse and the loss of investments

• Trade wars and other international conflict

• Pay-as-you-go essential services or no essential services

• Insurance will not be available

• Risk will be everywhere

–Stoneleigh, “Century of Challenges” DVD and June 2011 live lectures

Stoneleigh talks deflation; others talk inflation. Which will we see? Honestly, it doesn’t matter. The magnitude of the looming inflation and/or deflation is so extreme that it will destabilize the steady economic system that most of us alive today have always known. Thus our Transition communities must prepare for either, for both, and for cataclysmic systemic failure.

(What can we do? See Part III)